Plastic pyrolysis – also called chemical recycling, thermal/catalytic cracking, and thermolysis – is the high-temperature molecular breakdown of plastic waste into smaller molecules in an inert atmosphere and the most promising and mature end-of-life solution for highly mixed, dirty, and troublesome plastic waste streams. Several plastic pyrolysis developers have reached an appreciable demonstration-scale but are unable or unwilling to raise the $100+ million in capital needed for successful commercial operations. As a result, the oil and gas (O&G) industry, driven by the need to meet an ever-increasing demand for sustainable materials, has begun to dominate scale-up through licensing and joint venture agreements with leading developers.

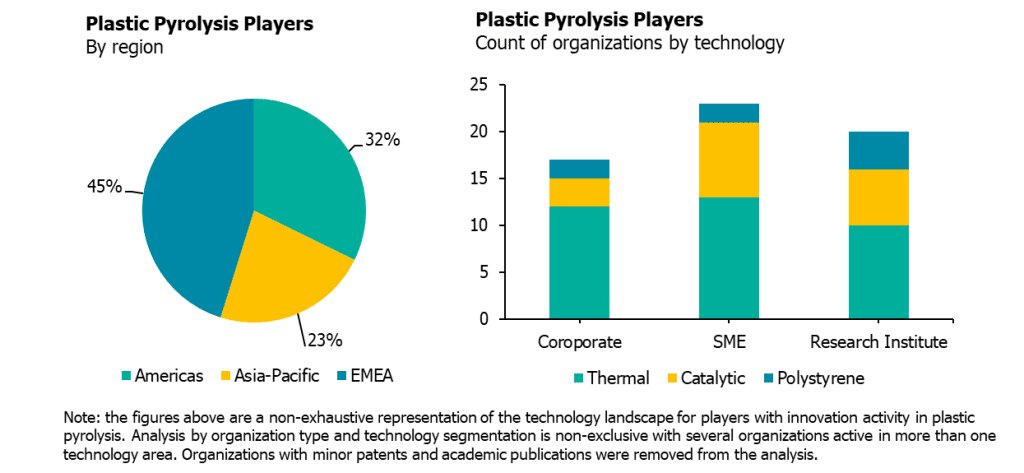

Plastic pyrolysis has several variations in processing temperature, which affects the overall yield and char production; catalyst use, which affects the composition and weight of the product; and target waste streams, which also affect the composition and weight of the product. Based on these factors, we segment the plastic pyrolysis landscape into three broad categories: thermal pyrolysis, catalytic pyrolysis, and polystyrene pyrolysis. Participants span the globe (Americas, EMEA, and Asia-Pacific) and consist of a relatively even mix of small-to-medium enterprises (SMEs), research institutions, and corporates. To provide a comprehensive overview of this landscape, we leveraged various Lux data tools alongside our existing coverage to compile a list of relevant organizations. This information serves to define key trends and identify opportunities for clients seeking to engage and enter the market.

- EMEA sees the most corporate and SME activity, but Asia-Pacific sees a growing share. Many SMEs, research institutions, and corporates developing plastic pyrolysis technologies are based in either EMEA or the Americas, but research activity in China is growing steadily, with a heavy emphasis on catalytic pyrolysis to fuel products. Western Europe and, to a lesser extent, Eastern Europe and the U.S. are the first targets for commercial-scale expansions.

- Development focus has shifted toward steam-crackable pyrolysis oil in recent years despite low oil prices due to O&G industry involvement. Thanks to their origins in biomass pyrolysis, early plastic pyrolysis developers exclusively targeted fuels; however, the exclusion of PVC and PET allows plastic pyrolysis to produce a product similar to crude oil, enabling downstream refinement via steam cracking into various sustainable petrochemical products after upgrading. Despite a poor competitive outlook compared to crude oil – upgraded pyrolysis oil will cost more than $90 per barrel – O&G investors continue to push this area of development. The pyrolysis of polyolefins like polyethylene (PP) and polypropylene (PE) produces alkane and alkene aliphatic oils, polyvinyl chloride (PVC) produces problematic hydrogen chloride and aromatic oil, condensation polymers like polyethylene terephthalate (PET) add oxygen content and produce aromatic oil, and polystyrene (PS) produces aromatic oil.

- A regulatory reckoning is coming for plastic pyrolysis. Is pyrolysis sustainable? The answer to this question will be the single largest factor determining plastic pyrolysis’ viability in each region. While it does have a lower CO2 footprint than the most common types of incineration, it is nearly equivalent to incineration with energy recovery. Worse, pyrolysis has a larger CO2 footprint than landfilling and using a relatively cheap source of oil to produce primary plastic. This sustainability concern is unlikely to be an issue in China, where there is a large opportunity to replace standard incineration and fuel regulations are less stringent, or in Japan, where waste accumulation and a desire to increase recycling rates are likely to be bigger drivers of adoption. But in other geographies like Europe, the question of how to sustainably use pyrolysis is likely to be a major sticking point. Pyrolysis’s problematic CO2 footprint and the difficultly of converting it back into plastic are likely to limit its favorable treatment by regulators and thus its potential.

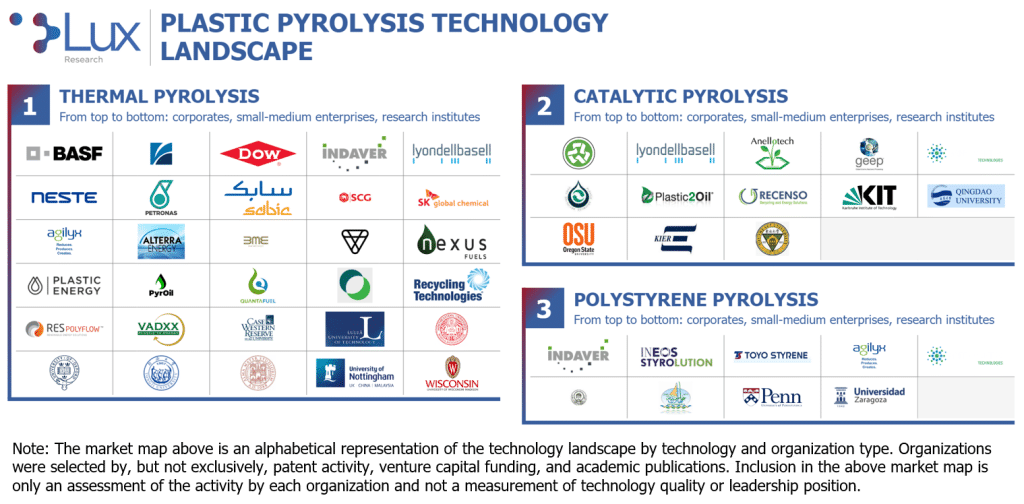

- Thermal pyrolysis. The most popular form of plastic pyrolysis, it utilizes heat and pressure to induce both chain end and random degradation to produce a product stream with weight ranging from single-carbon gas (methane) to C35+ waxes. The yield of thermal pyrolysis is determined by the reaction temperature: Low-temperature thermal pyrolysis (around 400 °C) – also called “slow pyrolysis” – has relatively long residence times and high yields, while high-temperature thermal pyrolysis (around 700 °C) typically requires an extra pretreatment step to increase the surface area of the feedstock, has much shorter residence times, and has lower yields due to higher production of char; most developers fall somewhere between slow and fast pyrolysis, with more weight toward low-temperature processes. Thermal pyrolysis produces the pyrolysis oil best suited for steam cracking refinement.

- Catalytic pyrolysis. The most diverse form of plastic pyrolysis, it utilizes heat and pressure to induce both chain end and random degradation controlled by a catalyst to produce a product stream with a relatively narrow distribution of weight and, in some cases, specific molecules like benzene, toluene, and xylene (BTX). While a wide range of synthetic catalysts, such as ZSM-5, HZSM-5, and FCC, have been used in catalytic plastic pyrolysis, they have been limited by their high cost. Naturally occurring zeolite catalysts have recently begun gaining traction as a low-cost but effective alternative. Catalytic pyrolysis is best suited for producing specific product streams, such as BTX or gasoline with a high octane rating, but is struggling to overcome the increased cost of production

- Polystyrene pyrolysis. Thermal pyrolysis performed specifically on polystyrene feedstocks, polystyrene pyrolysis, is being used as a marketing tool by large polystyrene manufacturers to present an end-of-life solution for their products, which are facing ever-increasing environmental opposition. While the pyrolysis of polystyrene-exclusive waste streams does allow for a slightly lower energy input, the long-term availability of polystyrene-exclusive waste streams is dubious at best. Polystyrene pyrolysis does not utilize any specialty equipment, allowing those developers not already involved in mixed plastic waste to make an easy transition toward a more holistic waste solution after polystyrene pyrolysis inevitably fails. (Note: Polystyrene depolymerization, a technology being developed by the likes of Pyrowave and ReVital Polymers, is fundamentally different, though it will eventually struggle from the same feedstock bottleneck limiting polystyrene pyrolysis.)

Interest in and funding for plastic pyrolysis has exploded in recent years as the O&G industry scrambles to bring its own sustainable option to the market. At this point, almost every major player has some sort of involvement, and most are actively building or financing 100,000+ ton input facilities; however, very low crude oil prices have had a drastically negative effect on the pyrolysis oil to chemicals value proposition. As a result, many O&G companies now plan to blend pyrolysis and crude oil streams in a mass balance approach to help offset this increased price.

Although the demand for sustainable materials remains strong and the O&G industry must develop new product streams to retain its stranglehold on the materials and chemicals market, plastic pyrolysis’ process economics are simply not strong enough to compete in a neutral regulatory environment. Consequently, a regulatory reckoning is coming for pyrolysis – where will it be considered a sustainable end-of-life solution? Those interested need to pay close attention to this debate, as it is the biggest determining factor for plastic pyrolysis’ long-term success.