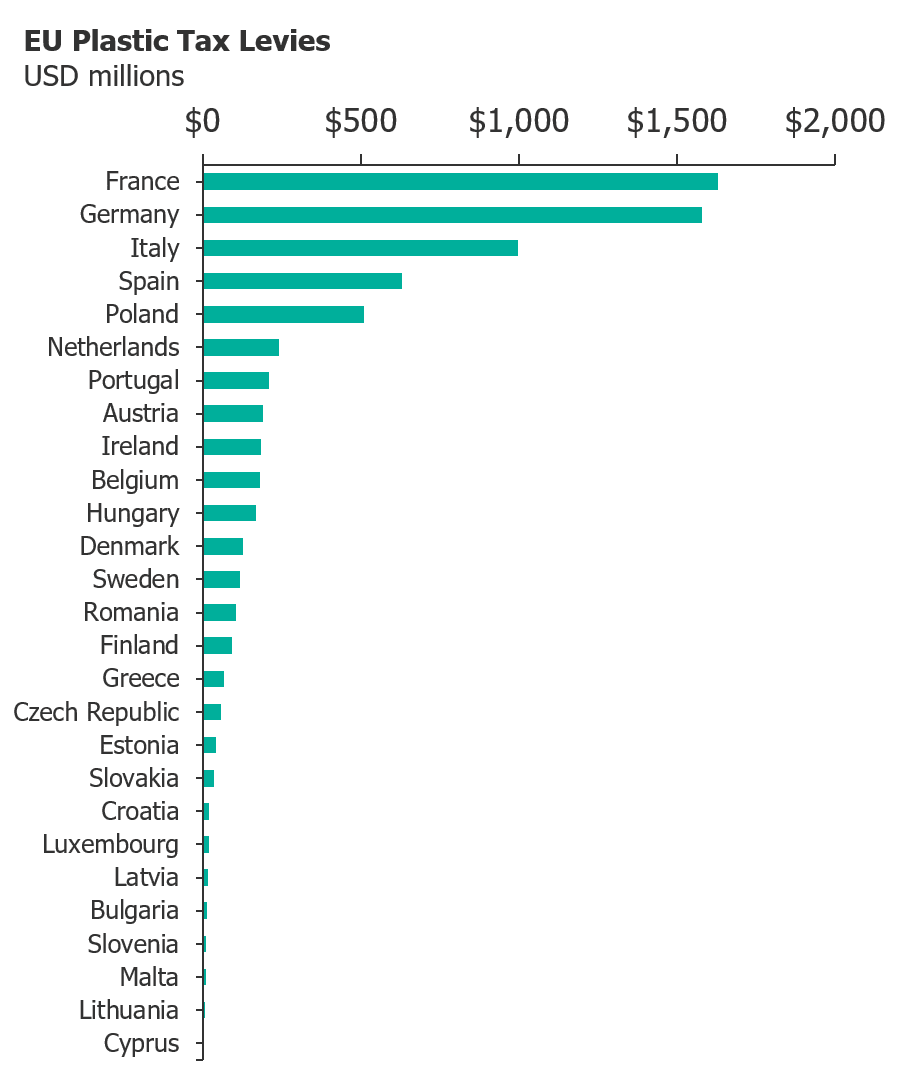

On January 1, 2021, the European Union implemented a new plastic tax based on nonrecycled plastic waste. The amount owed by each Member State is calculated by Eurostat according to the weight of non-recyclable plastics packaging placed on each Member State’s market during the previous year; the amount of plastic waste recycled has no impact. The rate of this tax is $0.96 per kilogram with a lump sum rebate for Member States with a per capita gross national income below the EU average. The tax is expected to generate $7.9 billion annually, after about $950 million in rebates, and will be used to support the general EU budget.

As with most EU taxes, an annual levy was calculated for each member state at the beginning of the year, who are now deciding on how to finance the tax. Most countries will rely on extended producer responsibility (EPR) compliance organizations (PROs) to pass fees to their corporate members through a proportional increase in EPR fees paid by members. The exact mechanism of these EPR fees is now being determined at a country level according to the amount of money that needs to be raised and how the country wishes to incentivize the removal of non-recyclable plastics from its domestic market.

A divide is emerging between those with high and low annual levies: most with large levies are taxing non-compostable or non-recycled-content-containing packaging materials – a very large segment of their packaging market – while those with smaller levies are only taxing small segments such as composite plastics and plastic-coated paper. The disparity in types of taxes between heavily and lightly levied countries will allow certain small EU domestic markets to avoid major changes, but all major markets are being affected in similar ways. Any imports to a country will need to comply with its new domestic tax scheme.

Lux Expects Four Main Outcomes from the EU Plastic Tax:

- Wherever possible, packaging companies will shift towards non-plastic materials such as wood, paper, cotton, or metal. While this transition is already underway thanks to the Single-Use Plastic directive, the Plastic Tax will accelerate the progress.

- Packaging companies will shift towards more recyclable packaging such as converting multilayered, multi-material flexible packaging to multilayered, single-material flexible packaging. As we’ve already seen, this may be a boon for polyethylene (PE) as developers can easily modify its density and properties to create the effect of multilayered packaging with a single material, drastically improving recyclability.

- Regardless of what materials are used – conventional plastics, alternatives, or recycled content – the ratio of packaging cost to product cost is going to increase. This may enable more expensive packaging options, such as the integration of tracers or active packaging.

- While the Plastic Tax will not directly fund the development of recycling infrastructure (a controversial point), we will see a rise in the incorporation of recycled content, improving recyclers’ margins, and encouraging capital investment.

#LuxTake

Although we can establish trends among the most and least affected EU member states and predict general outcomes, the numerous and slightly different domestic strategies being developed to recoup the Plastic Tax burden are complicating the European packaging market. As such, a “one size fits all” approach to European packaging is no longer viable – a strategy should be developed for each nation to align with their new standards.

Within the chaos of shifting European standards and increasing packaging cost, several opportunities for packaging innovation have emerged. Who will be the first to develop reusable packaging in Spain and avoid the tax? Who will be the first to develop packaging using Finland’s natural resources and avoid the tax? To help you formulate a response to this tax, and other policies poised to impact the sustainable materials market, be on the lookout for our upcoming report, “Policies Impacting Sustainable Materials.”